Selling your property in London

We sell more homes in London than any other agent, helping hundreds of thousands of Londoners achieve the right result.

Everything you need to know about selling property in London.

From the documents required to sell a property to the costs involved, our detailed sellers’ guide will help answer all your questions.

Need some help when it comes to selling your home? Download our 'how to sell' guide to take you through all the steps involved when selling your home with Samson.

How to sell in England and Wales

Costs of Selling

Energy Performance Certificate (EPC)

EPCs are compulsory with the sale of a UK home and can only be awarded by accredited professionals. The assessment and resulting certificate typically cost between £60 and £120.

Estate agent's fee

Fees can vary depending on which agent you instruct and whether you instruct them on an exclusive or multiple agent basis. Some agents may be prepared to negotiate depending on circumstances. VAT will be added so to estimate this expense, calculate the fee based on the asking price of your property, and add a further 20%.

Property solicitor's fee

Solicitors fees can vary. If you are buying a new home at the same time, using the same solicitor for both transactions can have financial and administrative benefits. Some solicitors will charge by the hour, while others, including Londonwide Conveyancing, charge a flat fee.

Current lender's fee

If you have an existing mortgage and require a new one, the early termination of your old mortgage may incur administrative fees, or early repayment fees.

Removal and storage costs

If you are selling the property that you presently live in, there may be removal or storage costs when it comes to vacating.

Professional cleaning

You may wish to have your property professionally cleaned before potential buyers begin to view the property.

Repair work

Completing any repairs in advance will incur an immediate expense but can save money in the long term. When market demand is high, however, minor issues become far less significant.

Rental costs

If you live in the property you are selling, a buyer may want to move in before you have been able to buy your next home. If the prospective buyer is unwilling to wait, you may decide to rent a property while you continue the search for your next home.

Bridging loans

If you need to move quickly on the purchase of the new property before the sale of your previous property has gone through, a bridging loan may provide a way to cover the deposit, whilst you are waiting for the proceeds from that sale. Bridging loans can be arranged relatively quickly, and while the interest rate and arrangement fees may be higher than that you would pay on your current mortgage, there are generally no tie in periods and they can provide a helpful short term solution.

Capital Gains Tax

If you are selling a property that you do not live in, then you may have to pay Capital Gains Tax.

The Selling Process

1) Arrange a property valuation

Before selling your property, you will need to understand its current market value. A property valuation will provide a guide price for putting your property on the market.

2) Selecting and appointing an estate agent

Finding an experienced estate agent with expertise in your area will help you sell your property. The right estate agent will be able to provide useful advice throughout the process. They will be skilled in negotiating and will have the means to market your property to the right audience.

3) Instructing a property solicitor

A property solicitor, or conveyancer, undertakes the necessary specialised legal work required during the property selling process. Appointing a property solicitor at the point you put your property on the market can significantly speed up the process and reduce some of the stress.

4) What documents are required?

When selling a property there are a number of documents that will need to be in order.

5) Marketing your property

There are a number of ways to find prospective buyers for your home, and your estate agent can advise you on the approach that is most suitable for your property. Having a strong marketing strategy is key to ensuring your home is seen by the right buyers.

6) Optimising viewings

Preparing your property for sale can take some time, so it is best you begin the moment you decide it is time to sell. It is also advisable to finish any outstanding DIY tasks you may have, and consider redecorating and touching up any chipped paintwork.

7) Negotiating and considering offers

Once an offer has been made, your estate agent will carry out checks on the buyer and then inform you both verbally and in writing of the details. Whether or not you accept an offer is your decision, but your estate agent will be able to give you guidance on whether they feel there is an opportunity to negotiate.

8) Agreeing the sale, exchanging contracts and completing

When an offer is accepted, a memorandum of sale is usually issued to set out the details of the transaction and to declare both parties’ intent to complete the transaction.

9) Ensuring the sale goes smoothly

There are several steps you can take to help the sales process move along smoothly and without delay.

Guide to Energy Performance Certificates

All sellers are required to provide an up to date Energy Performance Certificate (EPC) when selling a property. This assessment must be carried out by an accredited domestic energy assessor.

The cost of the assessment and the resulting certificate is typically between £60 and £120. The certificate contains information regarding the property’s energy use and typical energy costs. It also makes recommendations about how energy use can be reduced.

How are EPC assessments conducted?

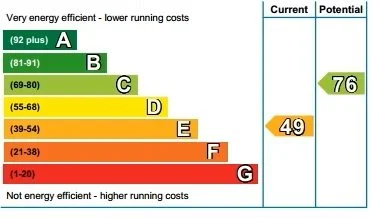

Each certificate is valid for ten years, and each property assessed is given a rating from A (the most efficient) to G (the least efficient). The EPC rating of each property looks at the property’s energy use per square metre, the fuel costs, and the volume of CO2 emissions. The calculations are based on standardised assumptions rather than actual energy bills.

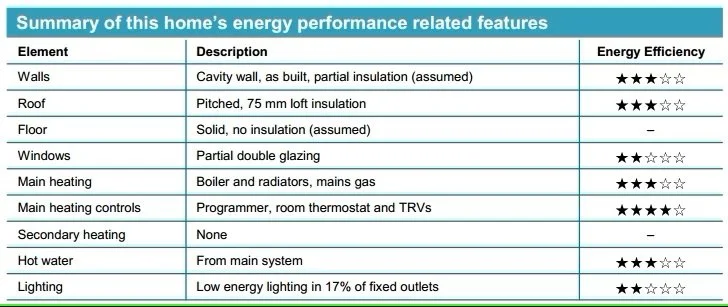

The walls, ceiling and floor will be judged for insulation, and the use of energy saving lightbulbs and double glazing all help improve the property’s rating. The heating system in place, whether a thermostat is fitted and the hot water delivery system are also taken into account.

Finding a qualified EPC assessor

Your estate agent will be able to recommend a company to carry out the assessment, but you can also shop around. The assessor will need to be accredited. Companies qualified to carry out EPC assessments can be found on the EPC register.

EPCs were initially introduced as a part of HIPS (home information packs). While HIPs were retired in 2010, it is still essential to have a valid EPC each time that a property is built, sold or rented.

Unless the owner has asked for it not to be made public, you can find historic EPCs of UK properties here.

EPC examples

The EPC gives your home an energy efficiency rating. It also indicates how the recommendations made within the certificate could improve the energy efficiency. The average home in England and Wales has a D rating.

The certificate considers various aspects of your home and assesses their energy efficiency.

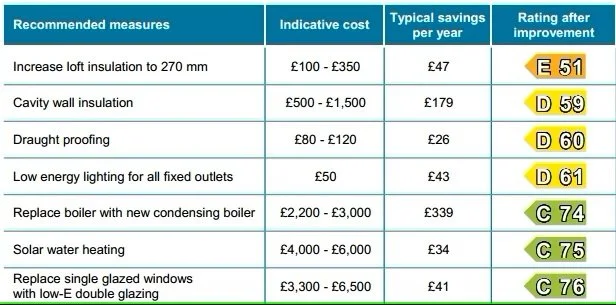

There are several recommendations made in the EPC that will improve your property’s energy efficiency. An indicative cost is given for each recommendation alongside the amount of money that could be saved by following the recommended course of action.

Information that needs to be disclosed as part of a sale

Consumer protection regulations (CPRs) dictate that a seller must disclose any pertinent information they have about the property which might influence the prospective buyer’s decision.

The following list provides an indication of the type of information that requires sharing:

The reasons why previous sales have fallen through

Any problems highlighted in previous surveys, i.e. subsidence

Any pending, approved or declined applications for planning permission

Any proposals for nearby development and construction

Whether the property lies beneath a flightpath

Whether the property is within sight of a motorway

Whether a power plant or substation is nearby

Any known structural issues with the property

Any public right of ways passing through the grounds

Any ongoing problems with neighbours, including boundary disputes

Any neighbours known to have been served an Anti Social Behaviour Order (ASBO)

Whether there have been any known burglaries in the neighbourhood recently

Whether any murders or suicides have occurred in the property recently

Any outstanding debts associated with the property, such as Green Deal loans (see below)

Any known pests in the property, or bats nesting in the eaves

Any known issues with problem weeds, such as Japanese Knotweed

It is important to not only be accurate with the information you provide, but also provide all the information that is relevant without omission. Providing misleading information, or failing to offer any relevant information, can result in criminal charges being levelled at the seller or estate agent.

To mitigate against this scenario, estate agents will generally issue a form called the Property Information Questionnaire (PIQ). This form will help you to disclose any issues that would affect the transactional decision of the average consumer. You can find out more information on the PIQ on the propertymark website.

Whether or not a piece of information is deemed to be relevant may depend on each case. If in doubt, speak to your solicitor or estate agent.

If there is a suspicion that an element of the property should be repaired, for example the roof or an extension, then the matter must be investigated.

The floorplans and photos used to promote the property need to accurately represent the property and cannot be judged to be misleading. You will generally be asked to approve the brochure of your property by your estate agent.